The year is 2007; and it is a year that Oprah declares “a year to get richer”. I got very excited at hearing this for a lady who has the billions to prove that “You can do it, with a lot of hard work.” She had the money guru advisor, Jean Chatzky, to come assist and advice people on how to make the changes to get all this extra money. I personally need this woman in my life. Has any of you got the kind of advise and support from a financial advisor in a bank that you felt would be beneficial? I personally have left each bank feeling more lost than assisted. I am not saying they should offer or give more money or increase my credit card limit but simply give me the kind of advise that can make me get rid of the debt I have with them? Clearly I am naïve; as the lesson I learned on Oprah is it is my responsibility to make the change! That is damn hard work!

Oprah started the show by calling on stage Lindsay and Matt, Kathi and Steve and Diana; who have so much debt that they need help to make ends meet. The Money Magazine team was waiting to assist the people and get hem richer within an hour. No Pressure! I was not convinced they’d be able to find anything from these poor people funds. I was praying for some Oprah giving and just paying off their school fees; at least! They could have also been praying the same dream.

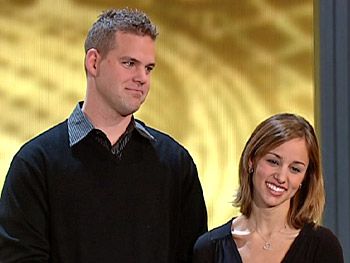

Lindsay and Matt

Lindsay and Matt

25 and 29 years old Newlyweds; pregnant; earning about $97,000 a year; $6000 credicard debt; $65000 student loans.

Matt – spender; Lindsay – stingy! Gal’s gotta save! Education is expensive!!!

Kathi and Steve

Kathi and SteveBoth spenders! Both 51; four adult children, two of which still live at home. Earning about $100,000 a year, $34,000 in credit card debt; $700 spent on 22-year old sponging son. Kids are expensive! What did they buy on those credit cards?

Diana

Diana

23 years old and single. Earning about $50,000 a year; $6,000 credit card debt; $37,000 student loans. She ain't got no money to spend so we can't really tell whether she is a stingy person or a spender! Expensive education! Oprah could have helped here! :-)

Lindsey and Matt, were assisted by Ellen McGirt – The goal was a comfortable retirement figure! A long way to come but you got to save some money for your kids to spend when you can’t anymore. But, Honestly, how many people have you met that genuinely want to be comfortable in their old-age. Most people want to spend their money while they still can; young and agile! Therefore you find that most people find themselves taking care of their parents and their kids with the money they earn; creating another cycle of no retirement fund for yourself. You can’t even afford an old age home for the oldies! How many darkies actually utilize old age homes? Most darkies take their parents into their own homes. I know I am being a bit stereotyped here, please adjust my mindset!

The results: Matt has to sell his playstation and downgrade his car! Eish! Oprah even said this must be a blow to Matt; to come to the Oprah show and have to downgrade a car! They will open two Roth IRA's. Lindsay will contribute $250 a month into hers, and Matt will put $150 into his. At retirement, they will have $923,000! How long is this still to come?

Stephen Gandel assisted Steve and Kathi reduce a huge amount of money in their debt.

The couple was able to negotiate their credit card's interest rate from 29 percent to only 5.9 percent over the phone! Can you seriously get any assistance from our local banks telephonically for something this big? Is it possible to negotiate an interest rate with the local banks unless you are in the Sexwale range of earning? Do you need a personal financial advisor to be able to do it here? Has anyone of you gotten this kinda deal here in Mzansi!? Please send me the directions to your bank!!!

The results: Kathi and Steve made the critical decision to stop sending their sponging 22 year old son money to pay his bills. I don’t know if I would be really happy about this; if I was this son; Oprah taking away money from me like that. But start them early and they know Ma and pa ain’t got money! :-) He ain't gonna take them in if they don't save this money for retirement - He is gonna cut them off his will and not take care of them in their old age!

With this huge $700 saving :-) and the interest rate reduction, Kathi and Steve should have about $450,000 at retirement.

Cybele Weisser was given the daunting task of getting money saved from Poor Diana. Oprah just pay this gal's school fees!

Diana needs to get a roommate - Haibo! There goes her need for space! Well, for moola she's gotta get a roomza! Hopefully she gets a nice one or she is a nice person to live with. This little sacrifice will bring $300 a month into her "savings". She was able to find some get cash consolidation on her student loan which saved her $66 a month. The gym membership she ain't using, she had to give up to save. Roadwork will have to do!

The result: She saves $409 a month; at retirement she has $920,000! Does this take into consideration the increaseswhe will get?

As a true Oprah fan who sits through each and every show (late at night, for the SABC 3 repeats) I was really looking forward on the topic of getting rich in an hour… But I got to say I was not happy with the results espech for Diana. Simply because I fail to see how she will be able to do all this saving when she is already “living paycheck to paycheck.” I am quite cynical of her ability to save; I would like Oprah to do a follow-up on her. Will everyone stick to the advise and apply it? Will the money find other uses? I know mine would have! Unless you guys send me the directions to a bank that I can negotiate a very low interest rate of about 0.6%...